Just yesterday - almost literally, the news was that House Flipping is Down. Now, the news is that House Flipping is strong! What gives?

After reading an article published by Housing Wire, and written by Jessica Guerin, I want to share with you the statistics show that house flipping is strong again. The number of homes flipped in America is approaching its high of 2006, just before the crash.

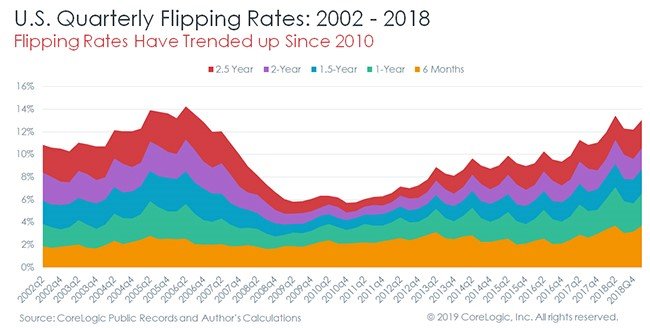

The latest data from CoreLogic reveals that 10.9% of all home sales in the fourth quarter of 2018 were flips, or homes that have been occupied for two years or less. This is the highest rate since the housing bubble days of 2006, when flips comprised 11.4% of home sales. (See chart below)

House Flipping accounts for close to 15% of the current home sales in America

The overzealous speculation of house flippers in the months leading up to the crisis is often cited as a contributing factor to the housing bubble. So should we be worried now that houses built on spec appear to be making a comeback?

No, says CoreLogic, citing evidence suggesting that the business practices of flipping is far better than what it used to be. Flippers are much more educated today, then they were 13 years ago. Instead of flipping homes based solely on price speculation, investors are flipping with a focus on adding real value to properties.

At Oregon Real Estate Investors our motto last year was “Making Neighborhoods Great Again!” as the majority of the members were focused on Flipping. Many of o ... Read More…